Why Virginia Drivers Need Protection from Uninsured Motorists

An uninsured motorist claim lawyer helps accident victims recover compensation when an at-fault driver has no insurance or not enough to cover the damages. This can happen if the other driver is uninsured, underinsured, or fled the scene in a hit-and-run.

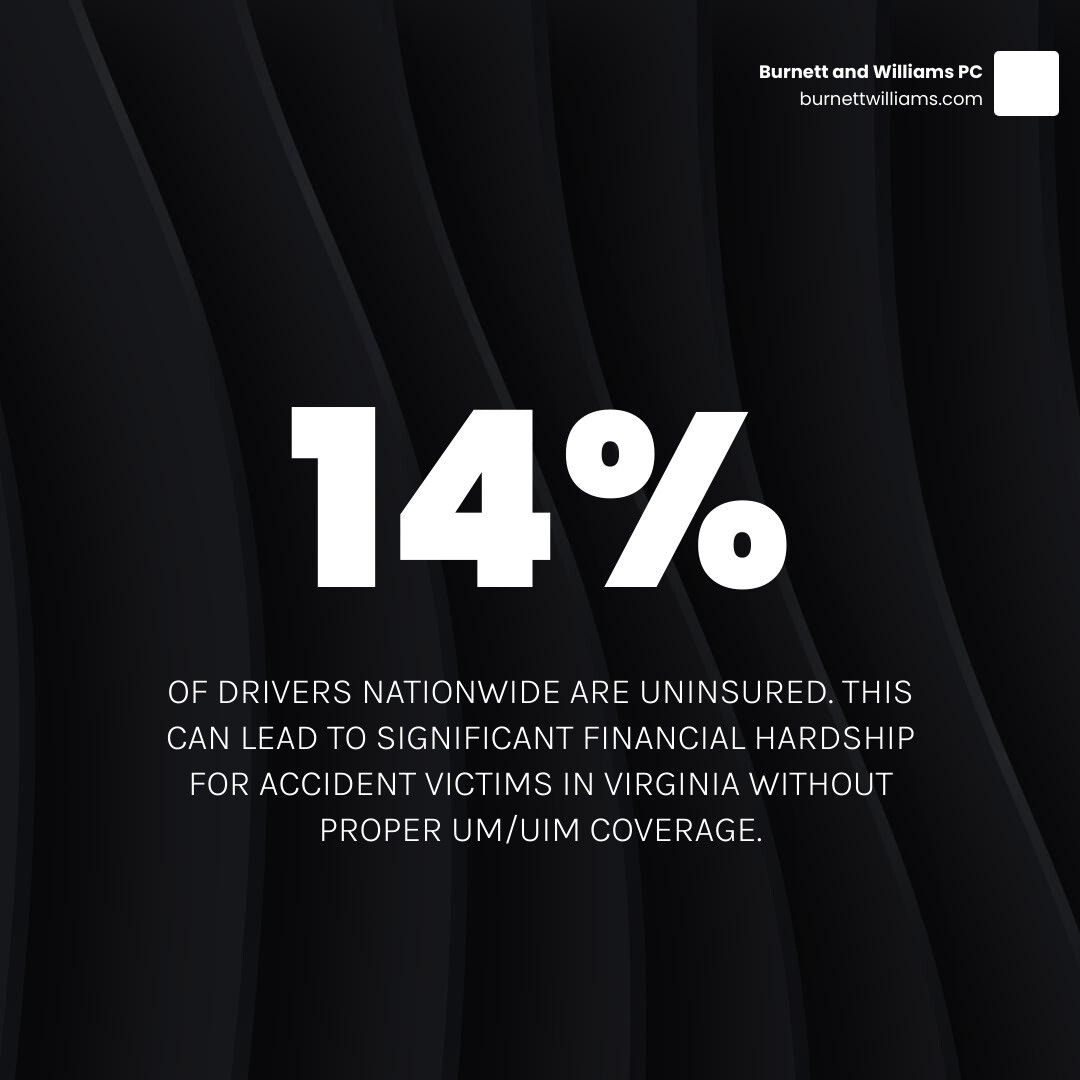

Getting rear-ended on I-66 in Loudoun County is stressful enough, but finding the other driver is uninsured can create a financial nightmare. Unfortunately, many drivers in Virginia are uninsured, making these cases far too common. Your own uninsured motorist (UM) coverage is your financial lifeline in these situations.

Virginia law requires insurers to offer UM and underinsured motorist (UIM) coverage. This is your safety net when the person who caused your injuries can’t pay. An attorney can help you:

- File a claim against your own UM/UIM policy.

- Steer Virginia’s complex insurance laws.

- Handle all negotiations with insurance adjusters.

- Pursue litigation if your insurer denies or delays your claim.

- Maximize your recovery for medical bills, lost wages, and pain and suffering.

While Virginia law provides these protections, insurance companies can make the process difficult. An experienced lawyer helps ensure you receive fair compensation.

Understanding Uninsured/Underinsured Motorist (UM/UIM) Coverage in Virginia

Think of your auto insurance as a safety net. While liability coverage protects others if you cause an accident, Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage protect you when someone else is at fault but can’t pay.

What is Uninsured Motorist (UM) Coverage?

In Virginia, your insurer must offer you UM coverage, which you must reject in writing if you don’t want it. This coverage is vital, as it applies even if you are a pedestrian or cyclist hit by an uninsured driver.

UM coverage is especially critical in hit-and-run accidents. When the at-fault driver cannot be found, Virginia law allows you to file a “John Doe” lawsuit. Your own insurance company then steps in to cover your claim for both bodily injury and property damage, acting as the insurer for the phantom driver.

Uninsured vs. Underinsured Motorists

The difference is simple: an uninsured motorist has no insurance at all. An underinsured motorist has insurance, but their policy limits are too low to cover your total damages.

For example, if a driver with Virginia’s minimum $50,000 liability coverage causes an accident that leaves you with $80,000 in damages, their insurance would only pay $50,000. If you carry $100,000 in UIM coverage, Virginia law allows you to tap into your policy for up to $50,000 more (your $100,000 limit minus their $50,000). Together, that adds up to $100,000 in available coverage, which would be enough to cover your $80,000 loss.

| Feature | Uninsured Motorist (UM) Coverage | Underinsured Motorist (UIM) Coverage |

|---|---|---|

| At-Fault Driver Has? | No insurance, or unidentified (hit-and-run) | Some insurance, but not enough to cover all damages |

| How it Helps You | Your policy pays as if it were the at-fault driver’s insurance | Your policy pays the difference between the at-fault driver’s insufficient coverage and your total damages, up to your UIM limits |

Understanding this distinction is key when dealing with Vehicle Accidents and determining which coverage applies.

What Damages Can UM/UIM Coverage Pay For?

UM/UIM coverage is designed to cover the full range of damages you would seek from an at-fault driver’s insurer. This includes:

- Medical Expenses: All costs for current and future medical care, from ER visits to physical therapy.

- Lost Income: Wages lost during recovery and compensation for any long-term impact on your earning ability.

- Pain and Suffering: Compensation for the physical pain and emotional distress caused by the accident.

In tragic cases, this coverage can also provide compensation in Wrongful Death claims. An uninsured motorist claim lawyer ensures all these damages are fully accounted for, not just what an insurer initially offers.

What to Do Immediately After an Accident with an Uninsured Driver

The moments after an accident are overwhelming, especially when the other driver is uninsured. The steps you take can protect your rights and your future claim.

Critical Steps to Take at the Scene

First, ensure everyone is safe and move vehicles out of traffic if possible. Then, take these steps:

- Call 911: An official police report is critical evidence for an uninsured motorist claim in Virginia.

- Exchange Information: Get the other driver’s name, contact details, and license plate number. Note if they admit to having no insurance.

- Do Not Admit Fault: Virginia uses a strict contributory negligence rule. If you are found even 1% at fault, you may be barred from recovering any compensation.

- Document Everything: Use your phone to take photos of vehicle damage, the accident scene, skid marks, and any visible injuries.

- Talk to Witnesses: Get contact information from anyone who saw the accident. Their independent account can be invaluable.

Why Medical Documentation is Crucial

Seek medical attention immediately, even if you feel fine. Adrenaline can mask serious injuries like whiplash or concussions that may not show symptoms for hours or days.

Prompt medical records create a direct, official link between the accident and your injuries, making it difficult for an insurance company to argue they were pre-existing. This documentation is the foundation of your claim, demonstrating the full extent of your injuries and the cost of your recovery.

Be sure to follow all of your doctor’s recommendations, including attending all appointments and completing physical therapy. Insurance adjusters often use gaps in treatment to minimize or deny claims. For complex cases like those requiring Virginia Traumatic Brain Injury (TBI) Lawyers, consistent medical records are absolutely essential.

Navigating the Virginia UM/UIM Claim Process

After an accident, you face the insurance claim process. Even when filing with your own company for a UM/UIM claim, the path can be surprisingly complex.

How to File a Claim and Deal With Your Own Insurer

Notify your insurance company immediately. Prompt reporting is required by most policies. Stick to the facts and avoid speculating on fault or downplaying your injuries.

For hit-and-run accidents, Virginia allows you to file a “John Doe” lawsuit, which lets you access your UM coverage even if the driver is never found. You will need to prove the other driver was uninsured, often by working with the Virginia DMV and using the police report.

Your insurer has a potential conflict of interest: they are supposed to protect you, but they also want to minimize payouts. This is why an uninsured motorist claim lawyer can be a critical guide through the Case Process.

Understanding Virginia’s Deadlines and Legal Problems

Virginia law is strict. You have two years from the accident date to file a lawsuit. Miss this deadline, and your case is likely over.

The biggest legal hurdle is contributory negligence. Under this harsh rule, you can be denied all compensation if you are found even 1% at fault for the crash. Additionally, accidents involving government vehicles may require a special notice within just six months, so acting quickly is essential.

How an Uninsured Motorist Claim Lawyer Handles Settlements

An experienced lawyer takes over all communication with the insurer. We start by calculating your claim’s true value, including future medical needs and lost earning capacity, not just current bills. We then present a detailed demand package and negotiate forcefully against lowball offers.

If negotiations fail, we can pursue arbitration or file a lawsuit against your own insurance company to compel them to pay what your claim is worth. Our goal is to ensure you receive the full protection you paid for in your policy.

Why You Need an Experienced Uninsured Motorist Claim Lawyer

When your own insurance company starts acting like an adversary after an uninsured motorist accident, you need an experienced uninsured motorist claim lawyer. Even though you are their policyholder, their goal is often to pay as little as possible.

Overcoming Common Insurance Company Tactics

Insurers use common tactics to minimize claims. These include making lowball settlement offers that don’t cover your true damages, requesting recorded statements to use your words against you, and imposing claim denials or delays to wear you down. An attorney recognizes these strategies and knows how to counter them. This is why Car Accident Injury Victims Should Have an Attorney Review any offer before accepting.

The Value an Uninsured Motorist Claim Lawyer Brings to Your Case

A lawyer does more than just file paperwork. We handle every aspect of your case so you can focus on recovery. This includes:

- Thoroughly investigating the accident and gathering evidence.

- Working with medical and economic experts to document your damages.

- Managing all communication and negotiations with the insurer.

- Navigating Virginia’s complex legal procedures, like the contributory negligence rule.

We ensure your rights are protected at every step. You can learn more about the support we provide by reviewing 8 Things Personal Injury Lawyer Can Do Virginia.

Potential Outcomes of Suing an Uninsured Driver Directly

While you can sue an uninsured driver directly in Virginia, collecting a judgment is often difficult. If the driver has no assets or income, a court award is just a piece of paper. While we can investigate their financial status, your UM claim is typically the most reliable and fastest path to compensation, providing the protection you’ve already paid for.

Frequently Asked Questions about Virginia Uninsured Motorist Claims

We frequently hear the same questions from clients dealing with the stress of an uninsured motorist claim. Here are answers to some common concerns.

What are the penalties for driving without insurance in Virginia?

Virginia imposes serious penalties. An uninsured driver faces fines, court costs, and a mandatory uninsured motorist fee payable to the DMV. Their driver’s license will also be suspended. Most importantly for you, they become personally liable for all damages they cause. However, since most uninsured drivers lack the resources to pay, your UM coverage is your best recourse.

Can I receive compensation if I was injured in an accident and didn’t have insurance myself?

This is a complex situation. Under Virginia’s fault-based system, you can still pursue a claim against the at-fault driver. However, you will face Virginia penalties for being uninsured. Furthermore, Virginia’s strict contributory negligence rule is a major hurdle. If the other side can prove you were even 1% at fault, you may be barred from recovering anything.

Will my insurance rates go up if I file a UM claim in Virginia?

Generally, no. In Virginia, filing a UM or UIM claim for an accident that was not your fault should not cause your rates to increase. You are using a “not-at-fault” coverage that you have paid for. Virginia law recognizes that you had no control over the other driver’s lack of insurance. Do not let fear of a rate hike prevent you from seeking the compensation you deserve.

Conclusion: Protecting Your Rights and Your Future

Being hit by an uninsured driver is stressful, but it doesn’t have to ruin you financially. Virginia law provides a powerful safety net through your Uninsured and Underinsured Motorist coverage. This is a right you have paid for, and it is worth protecting.

Don’t steer this complex process alone. Virginia’s strict laws and insurance company tactics can jeopardize your claim. At Burnett & Williams PC, we support clients across Virginia in seeking the compensation they need. If you’ve been injured, contact us to understand your options and let us fight for you. Learn more about our personal injury attorney services.