Life saving intervention leaves a patient with nearly 100k in medical bills after insurance.

In a rare decision by a circuit court, a judge decreased the amount a patient owed to a hospital by over $80,000. This was the result of lawsuit where a hospital in Martinsville, Virginia sued a patient alleging a breach of contract for unpaid medical costs.

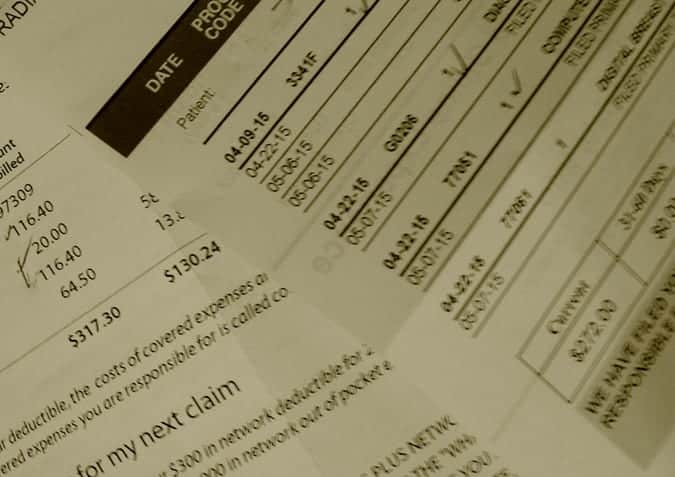

After being rushed to the hospital for severe chest pains, the patient, fearing a heart attack, was told he had to sign several documents before the hospital could begin treatment. The patient signed the documents and went into surgery where he received several stents in his arteries. The hospital charged the patient over $111,000, but the patient’s insurance covered only $27,000, leaving him on the hook for the remaining costs. After several requests from the patient to see the lists of charges, the hospital repeatedly told him that they were “secret” and would not be shared with him.

The judge ruled that the contract signed by the patient was invalid because it was a “contract of adhesion.” A contract of adhesion is a standard-form contract prepared by one party, to be signed by the party in a weaker position — usually a consumer who adheres to the contract with little choice about the terms. The judge further stated that at the time the contract was signed, the patient had a reasonable belief that he was having a life-threatening heart attack, and thus he was in no position to reject the agreement at the time. As a result the judge slashed the remaining balance owed.