How to Find Help After Suffering a Serious Injury

In the aftermath of a serious injury, finding help after a serious injury can be difficult. Support is crucial in navigating the challenges and uncertainties

In the aftermath of a serious injury, finding help after a serious injury can be difficult. Support is crucial in navigating the challenges and uncertainties

Suffering a severe injury can be a life-altering experience, impacting your physical well-being, financial stability, and overall quality of life. If your injury was caused

Losing a loved one due to another person’s negligence or wrongful actions is a devastating experience. In such challenging times, families in Virginia may seek

Losing a loved one, especially due to someone else’s negligence or wrongful actions, is unimaginable. In such heartbreaking situations, grieving families in Virginia have the

The best brain and spine injury attorney knows that brain and spine trauma can be among the most devastating experiences a person can face. These

Sustaining a spine injury can be a life-altering experience that impacts you physically, emotionally, and financially. Spine injuries occur for various reasons, including car accidents,

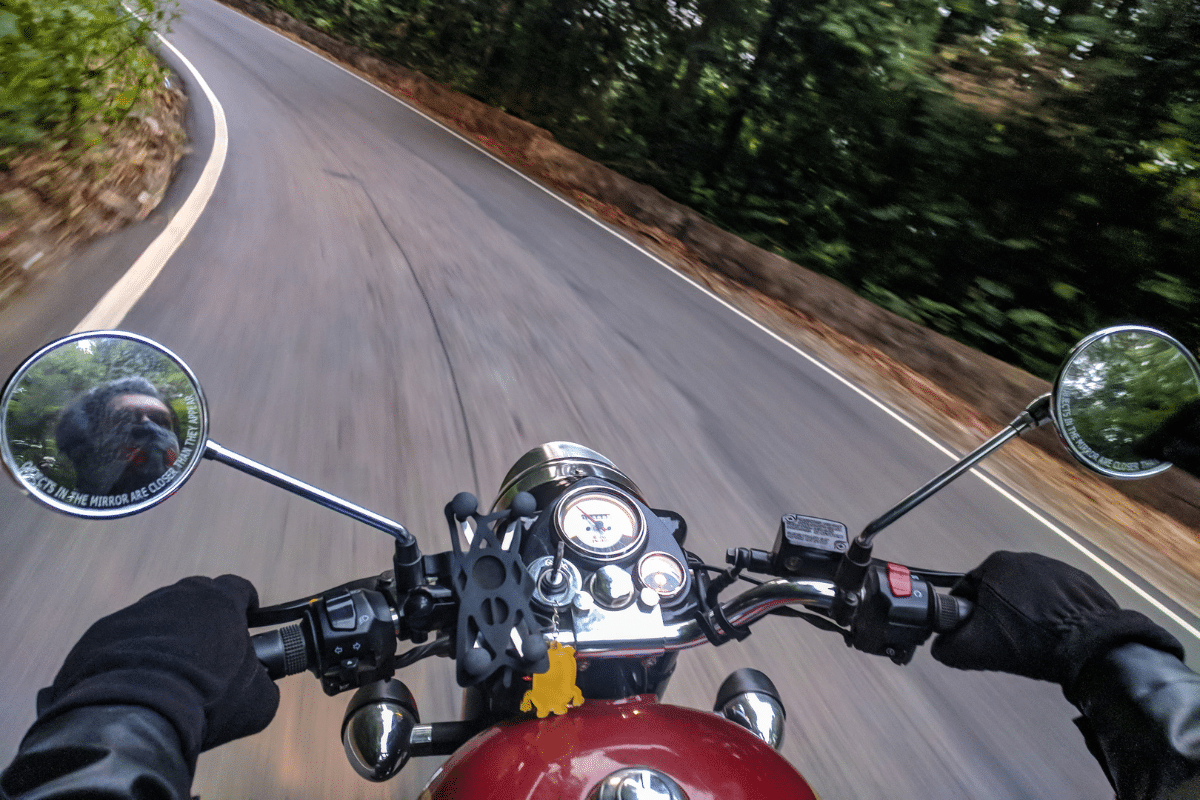

While motorcycle accidents make up a small percentage of all motor vehicle accidents, the injuries riders sustain are often severe. According to the Insurance Information Institute,

A head injury attorney can provide many benefits for individuals who have suffered a head wound, which may result in an injury to the brain,

A brain injury attorney can provide critical support for people who suffer a traumatic brain injury (TBI), which includes hundreds of thousands of Americans each

A bike accident attorney can offer crucial support when the unthinkable happens. Riding bikes for recreation and transportation is excellent for your health and the